Table of Contents

Estate planning is often misunderstood as something only the wealthy or retired need, but the reality is much different. With only 33% of Americans having essential estate planning documents, two-thirds are leaving their families unprepared for life’s uncertainties.

For estate planning attorneys, these statistics highlight a clear opportunity to find potential clients and educate them. Let's explore some notable estate planning statistics for 2025 and discuss the importance of improving your law firm’s SEO efforts to attract clients.

Key Insights from Estate Planning Trends

Estate planning is a proactive step to protect families and secure their financial future. People tend to push it off, so it's your job to reach them first.

Let’s dive into some compelling estate planning statistics that highlight the importance of proper estate planning.

- 43% of people said a health concern or medical diagnosis would push them to write a will. Some also cited buying a home or retiring as motivation to start estate planning.

- 60% of people haven't created a will or made any estate planning documents, leaving their assets completely unprotected.

- 15% of people worry their heirs won't be able to cover taxes or maintain the assets they'll inherit.

- Probate expenses can eat up to 10% of an estate.

The data above show 3 key observations: people often wait for significant life events to take action, a majority remain unprotected, and there's substantial anxiety about asset transfer and maintenance.

A Data-Driven Overview of the Latest Estate Planning and Probate Law Trends

The trends we will discuss in this section provide insights into how people are planning their estates, ensuring their assets are managed, and distributed according to their wishes. This information can help you understand the exact circumstances of your target audience, so you can pinpoint exactly how to market your firm to them.

— Estate Planning Law Stats

While most people assume estate planning is something to worry about "later," the data tells a dramatically different story – revealing a generation caught between awareness and inaction. Here are some stats you need to know:

- Over 41% of individuals (18-34) and 34% of individuals (35-54) have never had a conversation about estate planning with anyone.

- About 70% of property owners intend to transfer their properties to the next generation through inheritance.

- Getting through probate isn't quick – the process can stretch from several months to multiple years.

- 35% of American adults have either personally experienced or know someone who faced family disputes because they lacked proper estate planning documents.

- For those 55 and older, the primary motivation for estate planning is minimizing family stress during end-of-life situations.

These statistics expose a critical generational disconnect. Younger demographics are significantly less likely to engage in estate planning discussions, creating a potential time bomb of financial vulnerability. The data suggests an urgent need for education and proactive legal guidance across age groups.

— Trust Litigation and Administration

These are financial instruments that offer strategic protection for assets across different economic brackets. Trust administration stats always reveal a complex interplay between wealth, legal strategy, and family protection. Take a look at some of them:

- While 56% of Americans understand why estate planning matters, only 33% have taken steps to document their final wishes. Of those who planned in 2021, 75.12% chose wills, 18.78% opted for trusts, and 6.1% chose a guardian for their young children.

- More than 60% of individuals holding $3-5 million in assets have trusts or plan to create them and 81% of people with $10+ million either plan for or have already established trusts.

As you can see, the gap between awareness and actually preparing estate planning documents is staggering. These prospects need an attorney and financial advisor.

Law firms that offer estate planning services have the chance to secure their clients’ legacies while positioning themselves as trusted leaders in this evolving market. Will your firm rise to the occasion?

— Contested Will Matters Stats

Factors like age, life experiences, and economic circumstances affect the estate planning process. These demographics can help you understand when and what your potential clients are searching for and how to meet them where they are.

- Less than a third of Americans currently have a will in place.

- Around 34% of parents cite having children as their main reason for starting estate planning.

- 41% of those with loved ones severely affected by COVID-19 have created wills, compared to 29% of those without direct exposure.

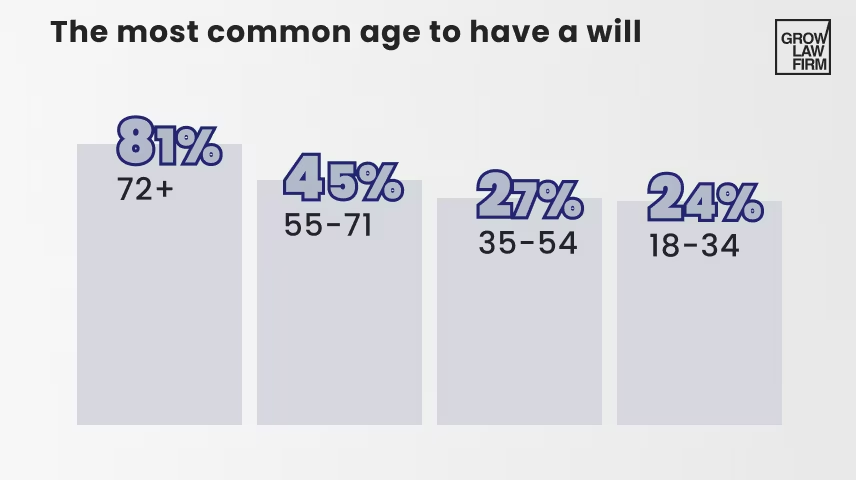

- Will creation varies dramatically by age group:

- Under 35: Only one in four have wills.

- Ages 25-54: Slightly over a quarter have taken action.

- Over 55: Nearly half have wills in place.

- Over 72: Four in five have protected their legacy.

- Among middle-income earners ($40-80K annually), time constraints prevent 42% from creating wills, while 32% believe their assets aren't substantial enough.

- College-educated parents typically leave inheritances averaging just under $92,700 to their families.

The data shows a clear pattern in how will ownership evolves with different life stages, income levels, and personal experiences. Significant differences exist between age groups, highlighting the importance of tailored marketing and education.

Reasons Why People Don't Have a Will

- 40% of American adults say they simply haven't made time for estate planning yet.

- 33% believe their assets aren't valuable enough to warrant a will.

- 13% of them think creating a will costs too much.

- And 12% don't understand how to start the will-making process.

— Statistics on Advance Healthcare Directives (Living Wills)

Living wills—also known as advance healthcare directives—ensure that a person’s healthcare choices are respected when they can’t make decisions for themselves.

Yet, surprisingly, many Americans still haven’t taken the necessary steps to secure these vital documents.

- 18% of Americans remain in the dark about what advanced healthcare directives actually do or how they work.

- Between 45% and 70% of older adults in end-of-life situations can’t make their own medical decisions, highlighting why advance care planning is crucial.

- 46% of older adults have legally documented their healthcare preferences, leaving families and doctors with clear guidance if they get sick.

— Asset Protection

For high-net-worth individuals, lawsuits threaten their most valuable assets.

A legal expert recommended an influencer to transfer liquid assets from California into an Asset Protection Trust based in one of the 19 states offering stronger asset protection laws. This move helps protect assets from lawsuits and other claims, ensuring financial security.

— Elder Law Statistics

As America's population ages, the stakes for proper estate planning keep rising. Managing wealth transfer and protecting elders is a lucrative market to tap into.

- Over the next three decades, American retirees plan to transfer more than $36 trillion to various beneficiaries, including family, friends, and nonprofits.

- Most Americans over 55 view dying without an end-of-life plan harshly – 52% call it irresponsible, 22% label it inconsiderate and 14% say it would be ignorant.

- Between July 2023 and June 2024, The U.S. Department of Justice uncovered over 300 cases of elder financial abuse, involving 700+ defendants who stole nearly $700 million from more than 225,000 older victims.

— Conservatorships and Guardianships

Conservatorships and guardianships protect individuals who cannot manage their own affairs. They provide legal oversight for vulnerable populations, ensuring their care and assets are properly managed. Your estate planning law services play a key role, given the stats:

- A 2017 Justice Department data show 1.3 million active guardianship or conservatorship cases nationwide, overseeing roughly $50 billion in assets.

- 43% of individuals with intellectual disabilities have court-appointed guardians managing their affairs.

- The typical person under conservatorship is a woman between the age of 76-81 with a modest income.

For legal professionals, this isn’t just another practice area—it’s an opportunity to make a meaningful impact by protecting individuals and strengthening families when they need it most.

Estate Lawyer Marketing Data

Every day, potential clients are searching for answers about their estate planning needs. The real question is: are you showing up where they're looking?

Online visibility is key. With most legal searches starting on Google, a strong SEO presence ensures your practice is seen by those who need you the most.

Let's dive into what the data tells us about how people find and choose their estate attorneys in 2025.

- When people start thinking about wills and trusts, 68% turn to Google first – before asking friends or family for recommendations.

- Top-ranked estate planning websites see ten times more potential clients than those stuck on page two.

- Younger demographics primarily turn to social media for guidance on things like how common estate planning is, whether they have enough assets, as well as everything about the probate process and retirement accounts.

These numbers make one thing clear: potential clients are actively searching online, they value local expertise, and they carefully research before reaching out.

Grow Law Firm is ready to help you turn these insights into action with estate planning attorney SEO strategies designed to drive qualified leads straight to your practice.

Estate Planning and Probate Law at a Glance: Final Key Points

With most Americans unprepared for life’s uncertainties, the need for estate planning services has never been greater.

However, reaching these clients takes more than skill — it requires strategic marketing to stand out in a competitive field. Digital marketing is the bridge between your expertise and the clients who need it most.

Grow Law Firm is a law firm SEO agency that turns market insights into real growth with more leads, more clients, and more revenue. Our full suite of services, from SEO and PPC to tailored web design is designed to drive long-term success. Contact us today!

.avif)

.svg)

.svg)